Key Highlights:

1. First and leading depository of India: NSDL is India’s first and largest depository in terms of number of issuers, active instruments, demat value of settlements, and value of assets under custody as of Mar’25. It has been instrumental in shaping the Indian capital market infrastructure, with its core depository platform servicing 79,773 issuers, over 3.95 crore active demat accounts, and operating via 294 DPs across 65,392 service centres, significantly ahead of its closest peer, CDSL.

2. Technology-led product innovation: The company has consistently driven technology-led innovation, having pioneered dematerialised securities in India. Its strong focus on platform stability, product innovation, and user experience has allowed it to stay relevant across diverse user segments. Revenue visibility remains strong, with a major share derived from stable, recurring sources such as annual custody fees from issuers and annual DP fees, rather than market-linked transaction charges. Additional revenue is earned via licensing and usage fees across other service offerings.

3. Strong subsidiary performance: NSDL has built complementary verticals through its subsidiaries. NSDL Database Management Ltd (NDML) operates as a tech-driven services provider, supporting ~1,728 SEBI-registered intermediaries and managing ~1.9 crore KYC records through its Central KYC Registry (CKYCR) licence. Meanwhile, NSDL Payments Bank Ltd (NPBL) delivers digital financial products, including prepaid cards, DBT-linked accounts, cash management solutions to corporate and government clients under a B2B2C model.

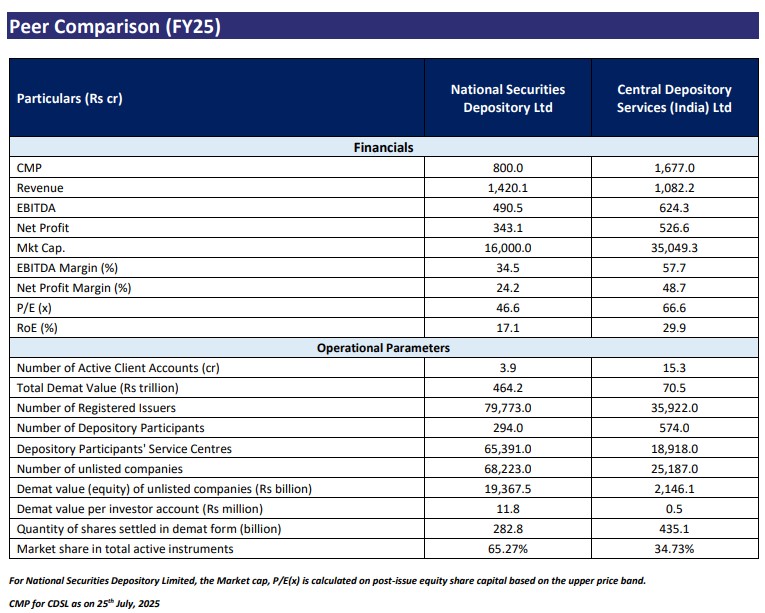

Valuation: NSDL reported a strong financial performance with a Revenue/EBITDA/PAT growing at a CAGR of 17.9%/21.2%/20.9% over FY23–FY25period, reflecting robust operating leverage. The company’s revenue model is largely stable and annuity-like, with over 60% of revenue derived from recurring sources such as annual custody fees charged to issuers and fixed annual DP fees. These recurring fees are independent of market turnover or transaction volume, providing insulation from market cyclicality. NSDL also generates revenue from licensing its DPM software, RTA services, and other auxiliary offerings. As of Mar’25, it had 86.8% market share by demat value and serviced 99.99% of the demat value of FPI holdings in India. At the upper price band of Rs 800, the IPO is priced at 47x times FY25 P/E, compared to its peer CDSL which is trading at 67x. The entire issue is OFS with IDBI Bank, NSE, SBI, UTI, HDFC Bank and Union Bank are the selling shareholders.