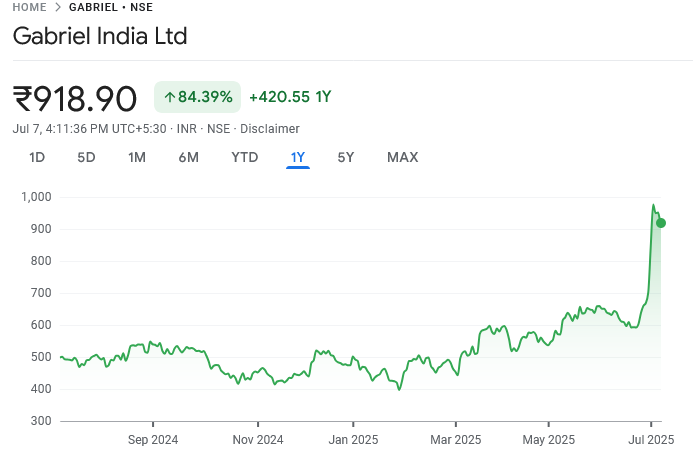

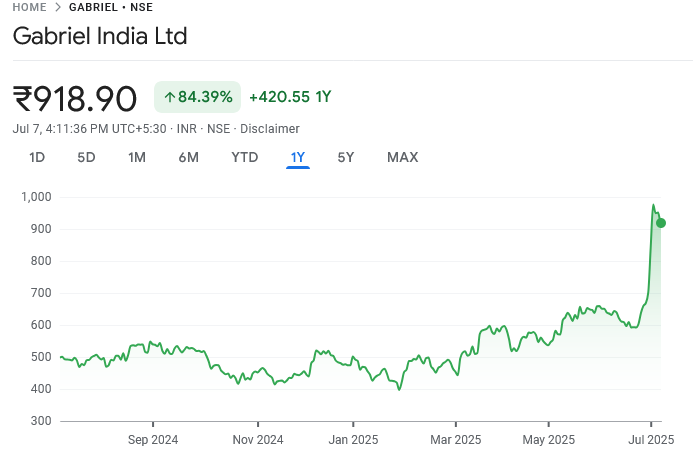

Gabriel India is up 85% YOY and has 47% more upside due to restructuring

Posted: Mon Jul 07, 2025 7:21 pm

Marks meaningful step forward in realization group strategic vision. Simplification of group structure and realign corporate structure to unlock synergy and enhance competitive edge. Gabriel India to play pivotal role in the transformation serving as group’s vehicle for future growth and platform. We lift our EPS by 36% for FY27 on EPS accretive acquisitions. We recommend a Buy rating at a sum-of-TP of Rs1,400 (earlier 770, 32x FY27e EPS), 32x on consol FY27e EPS of Rs32.5 (Rs1,040), future group consolidation (Rs260) and M&A potential (Rs100). Refer fig 18 for details.

Anand group unlisted companies consolidation into Gabriel. Scheme of arrangement annouced for acquisition of 25.1% stake in Dana Anand, 49% in Henkel Anand, 76% in Anand CY Myutec Automotive and 100% in Anchemco India from promoter stake in Anand’s group companies. Adds Rs41bn revenues (incl. associates topline) and Rs1.82bn attributable PAT as on FY25. EPS accretive by 41%/33% on FY25/27 EPS.

More group consolidation opportunity ahead. Anand group revenues is ~Rs200bn, out of which Rs40bn consolidated and current Gabriel revenue is Rs40bn, so currently it cover 40% value. In terms of profit >55% is still outside the Gabriel. Rest of group consolidation would be decided by board. EPS accretive benefit of ~Rs8 for other unlisted entities.

M&A. Anand group has 23 companies, 8 JVs, 4 technical collaborators and 20,000 employees. Anand group has business model of joint ventures or technical collaborations with global partners for diversifying into new product lines. Anand group targets to add Rs150bn revenues by 2030 through M&As. Gabriel now face of Anand group automotive growth engine. We expect acceleration of growth through M&As vs earlier plan of 1 per year.

Valuation. We expect robust, 22%/53%/38%, consolidated revenue/ PAT/ EPS CAGRs over FY25-27. We recommend a Buy rating at a sum-of-TP of Rs1,400. Key risks: Delay in upcoming group consolidation, less-than-expected growth in underlying segments, slower traction in M&As and new product lines, adverse commodity movement.

Anand group unlisted companies consolidation into Gabriel. Scheme of arrangement annouced for acquisition of 25.1% stake in Dana Anand, 49% in Henkel Anand, 76% in Anand CY Myutec Automotive and 100% in Anchemco India from promoter stake in Anand’s group companies. Adds Rs41bn revenues (incl. associates topline) and Rs1.82bn attributable PAT as on FY25. EPS accretive by 41%/33% on FY25/27 EPS.

More group consolidation opportunity ahead. Anand group revenues is ~Rs200bn, out of which Rs40bn consolidated and current Gabriel revenue is Rs40bn, so currently it cover 40% value. In terms of profit >55% is still outside the Gabriel. Rest of group consolidation would be decided by board. EPS accretive benefit of ~Rs8 for other unlisted entities.

M&A. Anand group has 23 companies, 8 JVs, 4 technical collaborators and 20,000 employees. Anand group has business model of joint ventures or technical collaborations with global partners for diversifying into new product lines. Anand group targets to add Rs150bn revenues by 2030 through M&As. Gabriel now face of Anand group automotive growth engine. We expect acceleration of growth through M&As vs earlier plan of 1 per year.

Valuation. We expect robust, 22%/53%/38%, consolidated revenue/ PAT/ EPS CAGRs over FY25-27. We recommend a Buy rating at a sum-of-TP of Rs1,400. Key risks: Delay in upcoming group consolidation, less-than-expected growth in underlying segments, slower traction in M&As and new product lines, adverse commodity movement.